Pioneering Financial Inclusion

The Central Bank of Nigeria (CBN) recently honored OPay, a leading fintech company, for its outstanding contributions to financial inclusion innovation. This recognition underscores OPay’s commitment to expanding access to financial services, particularly among underserved populations. Consequently, OPay’s innovative approach has significantly impacted Nigeria’s financial landscape, promoting economic growth and development.

The Power of Financial inclusion is crucial for economic development, as it enables individuals and businesses to access essential financial services. Furthermore, OPay’s innovative solutions have bridged the gap in financial access, empowering millions of Nigerians. In turn, this has led to increased financial stability and reduced poverty.

*Benefits of Financial Inclusion*

Financial inclusion has numerous benefits, including:

1. *Reduced Poverty*: Financial inclusion helps reduce poverty by providing access to financial services.

2. *Improved Economic Growth*: Financial inclusion promotes economic growth by enabling businesses to access capital.

3. *Increased Financial Stability*: Financial inclusion reduces financial instability by providing a safety net.

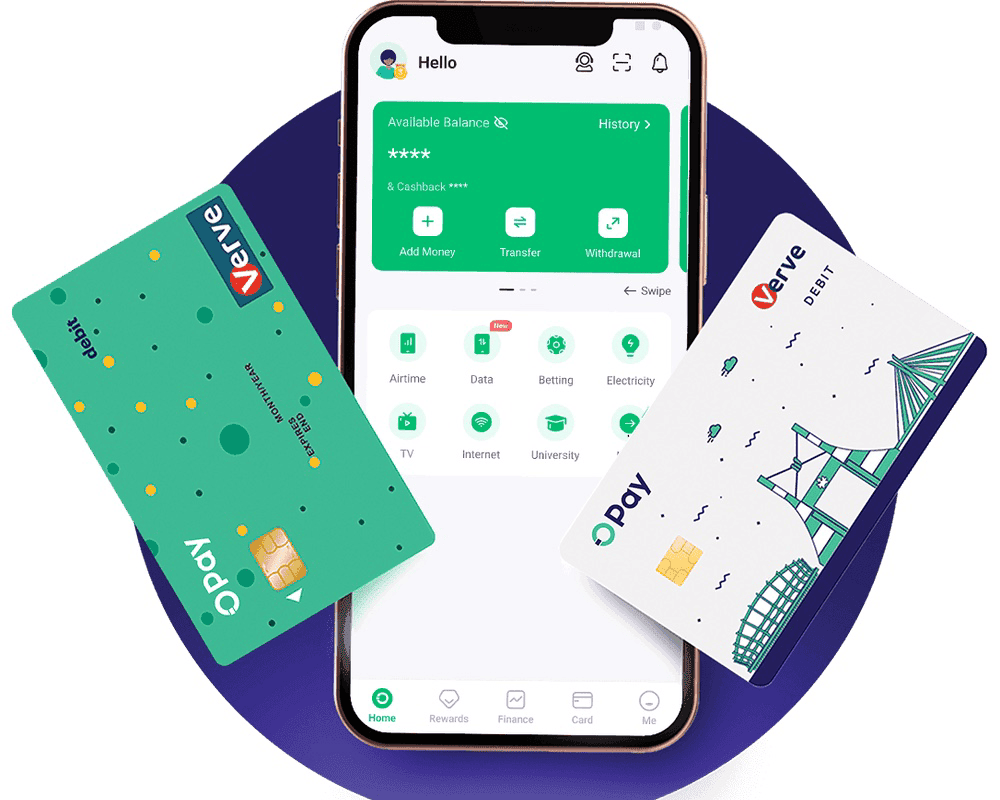

OPay’s innovative solutions include:

*Digital Payments*

1. OPay’s mobile payment platform enables seamless transactions, reducing cash-based transactions.

2. OPay’s digital payments facilitate easy transactions between individuals and businesses.

*Mobile Banking*

1. OPay’s mobile banking services provide access to financial services, including savings, loans, and insurance.

2. OPay’s mobile banking services are accessible via mobile devices.

*Merchant Services*

1. OPay’s merchant services facilitate transactions between businesses and customers.

2. OPay’s merchant services provide a secure payment gateway.

Impact of OPay’s Financial Inclusion Initiatives

OPay’s financial inclusion initiatives have had a significant impact:

1. *Expanded Financial Access*: OPay has expanded financial access to millions of Nigerians.

2. *Economic Empowerment*: OPay’s services have empowered individuals and businesses, promoting economic growth.

3. *Job Creation*: OPay’s operations have created employment opportunities.

CBN’s Recognition: A Testament to OPay’s Excellence

The CBN’s recognition of OPay’s financial inclusion innovation is a testament to the company’s excellence. Moreover, this achievement underscores OPay’s commitment to driving financial inclusion and promoting economic development in Nigeria.

Future Prospects

As OPay continues to innovate and expand its services, the future looks promising:

1. *Increased Financial Inclusion*: OPay’s services will continue to expand financial access.

2. *Enhanced Economic Growth*: OPay’s initiatives will promote economic growth and development.

3. *Collaboration and Partnerships*: OPay will collaborate with stakeholders to drive financial inclusion.

Conclusion

OPay’s recognition by the CBN is a significant milestone in Nigeria’s financial inclusion journey. In conclusion, OPay’s innovative solutions have transformed the financial landscape, promoting economic growth and development.

QuestExtra Key Takeaways

1. OPay’s financial inclusion initiatives have expanded access to financial services. ⁹/10

2. The CBN’s recognition underscores OPay’s excellence in financial inclusion innovation. ⁹/10

3. OPay’s services have promoted economic growth and development in Nigeria. ⁹/10

.

Opay is a game changer in the financial sector of naija.