National Debate Heats Up Over Nigeria’s Tax Reform Bills

Nigeria’s proposed Tax Reform Bills have sparked significant debate nationwide, raising questions about economic priorities, regional equity, and public trust. The conversation, driven by comments from political figures like Peter Obi and statements from the Presidency, highlights the complexity of reforming a system that affects businesses, government funding, and citizen livelihoods.

Background and Legislative Progress

President Bola Tinubu introduced four key tax reform bills to the National Assembly on October 13, 2023, following recommendations from the Presidential Committee on Fiscal and Tax Reforms led by Taiwo Oyedele. These bills include:

- Joint Revenue Board of Nigeria (Establishment) Bill (SB.583)

- Nigeria Revenue Service (Establishment) Bill (SB.584)

- Nigeria Tax Administration Bill (SB.585)

- Nigeria Tax Bill (SB.586)

These proposals aim to streamline tax collection, reduce multiple taxation, and modernise Nigeria’s tax infrastructure by consolidating existing laws and agencies.

Government’s Perspective: Necessity and Urgency

The Presidency argues that the reforms are essential to stabilise Nigeria’s economy. Bayo Onanuga, the spokesperson for President Tinubu, emphasised the long-standing complaints from businesses about multiple taxes and levies, which have hindered competitiveness and driven companies out of the country. The government believes these bills will create a more business-friendly environment, boosting investment and economic growth.

Onanuga stated, “The multiple taxes complicate the economic environment, making Nigeria uncompetitive for investment and preventing many businesses from growing or continuing their operations.” He further noted that phased implementation until 2030 allows affected agencies time to adapt and explore alternative funding sources, ensuring sustained service delivery without relying solely on earmarked taxes.

Criticism and Controversy: Regional Concerns

Despite the government’s assurances, the bills have faced criticism, particularly from Northern lawmakers. Concerns include potential adverse impacts on regional development and the funding of critical agencies like the Tertiary Education Trust Fund (TETFund). Seventy-three Northern legislators, including Senator Aminu Tambuwal, have voiced strong opposition, fearing the reforms could disproportionately affect their regions.

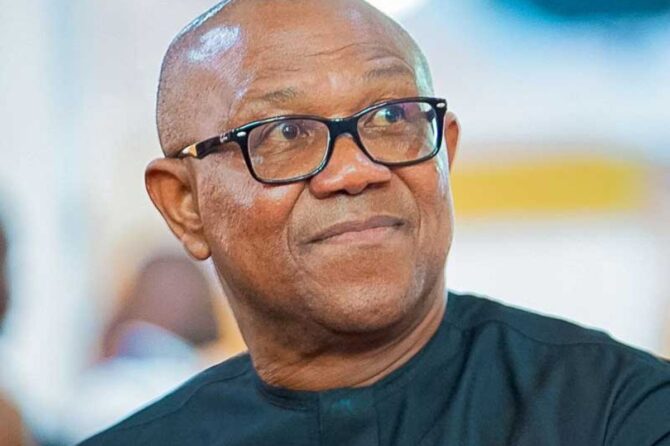

Peter Obi, the Labour Party’s 2023 presidential candidate, acknowledged the importance of tax reform but stressed the need for an inclusive and transparent process. He remarked on social media, “Such reform must be subject to robust and informed public debate. A public hearing is essential, allowing Nigerians from all walks of life to engage meaningfully.”

Obi’s call for extensive public hearings highlights a broader concern about ensuring reforms reflect diverse perspectives and do not exacerbate existing regional inequalities.

Suspension and Future Directions

The House of Representatives recently suspended its debate on the bills indefinitely, citing the need for broader consultations. This pause reflects the contentious nature of the reforms and underscores the importance of addressing stakeholder concerns. The Clerk of the House, Dr. Yahaya Danzaria, indicated that ongoing discussions aim to ensure comprehensive stakeholder input.

The suspension follows intense debates and public discourse, with calls from various quarters—including traditional rulers, civil society groups, and economists—for a measured and inclusive approach. The Presidency has urged stakeholders to participate actively in the upcoming public hearings, ensuring that all voices are heard and considered.

Implications for Nigeria’s Economy

If implemented effectively, the proposed reforms could simplify Nigeria’s tax system, enhance compliance, and boost government revenue. Streamlined taxation may attract more foreign investment and foster domestic business growth. However, the success of these reforms hinges on their ability to balance revenue generation with social and economic equity. Critics argue that without careful implementation, reforms could exacerbate regional disparities and erode public trust.

Key Considerations:

- Economic Impact: A simplified tax regime could reduce operational costs for businesses, enhancing competitiveness.

- Regional Equity: Ensuring that reforms do not disadvantage specific regions is crucial for national unity and economic balance.

- Public Trust: Transparent, inclusive policymaking processes are vital for gaining public support and ensuring sustainable reform outcomes.

What Next?

The proposed Tax Reform Bills represent a significant step towards modernising Nigeria’s fiscal landscape. However, their success will depend on addressing stakeholder concerns, fostering public trust, and ensuring regional equity. As debates continue, the focus must remain on creating a tax system that supports economic growth while promoting fairness and inclusivity.

The national conversation surrounding these reforms underscores a critical moment for Nigeria—one that will shape the country’s economic future and social cohesion for years to come.