Investors Await Rewards from President Tinubu’s Economic Reforms

Abuja, May 30, 2025 – As President Bola Tinubu marks two years in office, investors both domestic and international are cautiously optimistic about the long-term benefits of his administration’s economic reforms, which have begun to stabilize Nigeria’s macroeconomic environment despite persistent challenges.

Economic Reforms Yielding Early Results

Since taking office in May 2023, Tinubu’s government has implemented bold and often painful reforms, including the removal of the decades-long petrol subsidy, cuts to electricity subsidies, and the unification of multiple foreign exchange windows. These measures aimed to correct long-standing fiscal distortions and restore investor confidence.

President Tinubu declared in his anniversary address,

“Our economic reforms are effective. We are on track to establishing a stronger, more economically resilient nation.”

He acknowledged the hardships Nigerians have endured, particularly the cost-of-living crisis driven by inflation rates exceeding 23%, but stressed that these reforms were necessary to avoid a fiscal crisis marked by runaway inflation, external debt default, and a collapsing naira.

Positive Economic Indicators

- Fiscal Deficit: Reduced from 5.4% of GDP in 2023 to 3.0% in 2024, aided by improved government revenue collection.

- GDP Growth: Real GDP growth reached 4.6% in Q4 2024, with full-year growth of 3.4%, one of the strongest performances in a decade.

- Foreign Investment: Over $50 billion in foreign direct investments attracted since 2023, according to the ruling All Progressives Congress (APC).

- Tax Reforms: Nigeria’s tax-to-GDP ratio increased from 10% to 13.5% within a year, with new targeted incentives for manufacturing, agriculture, and technology sectors.

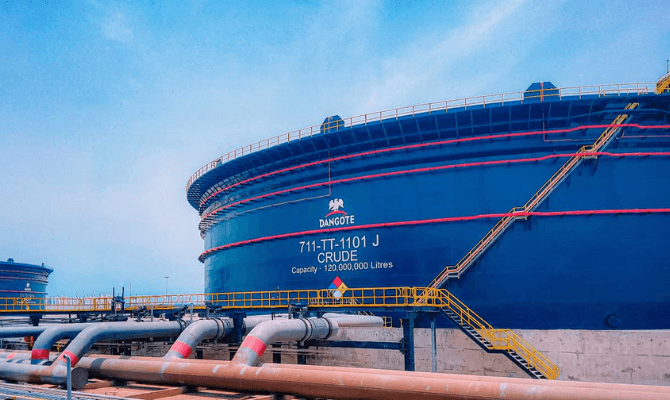

- Oil and Gas Sector: Rig counts have increased by over 400% compared to 2021, with more than $8 billion in new investments committed.

Investor Sentiment and Market Response

The reforms have restored investor confidence, with Nigerian banks emerging as major beneficiaries due to higher interest rates and improved liquidity conditions. The Central Bank of Nigeria’s Monetary Policy Rate was raised by 875 basis points to 27.5% between July 2023 and May 2025, boosting bank interest income and attracting capital inflows.

International financial institutions, including the World Bank and IMF, have acknowledged the positive trajectory but caution that high inflation and security challenges remain significant risks.

Government Initiatives to Ease Burdens

To mitigate the impact on vulnerable Nigerians, the government introduced zero Value Added Tax (VAT) on essential goods such as food, education, healthcare, and rent. A Tax Ombudsman is being established to protect small businesses and ensure fairness in the tax system.

President Tinubu also highlighted social investments, including revitalizing over 1,000 primary health centres and expanding health insurance coverage from 16 million to 20 million Nigerians. Efforts to diversify the economy include boosting the solid minerals sector and supporting digital jobs for youth.

Outlook

While inflation remains elevated and the cost of living is a daily concern for many Nigerians, investors are hopeful that the reforms will yield sustainable economic growth and improved business conditions. The administration’s focus on fiscal discipline, infrastructure development, and economic diversification is seen as laying the groundwork for long-term prosperity.

bf0ay1