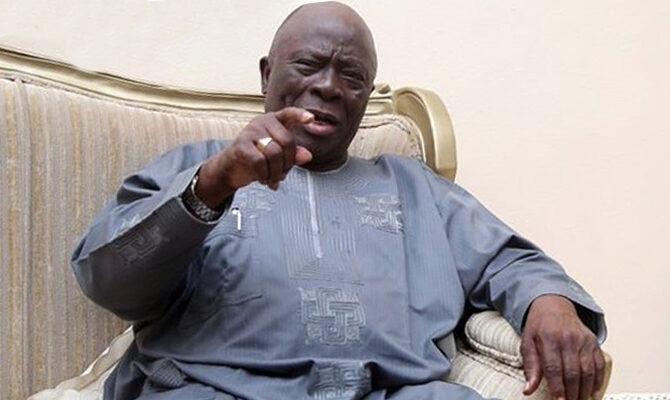

President Bola Tinubu Seeks Parliamentary Approval for $21.5 Billion External Borrowing

Abuja, May 27, 2025 – President Bola Ahmed Tinubu has formally requested approval from Nigeria’s National Assembly to secure $21.5 billion in external loans as part of the federal government’s 2025–2026 borrowing plan. The request, contained in a letter read during plenary sessions in both chambers of the National Assembly, outlines the government’s intention to use the funds to finance critical infrastructure, health, education, agriculture, water supply, security, and employment generation projects across all 36 states and the Federal Capital Territory.

Breakdown and Purpose of the Borrowing

The borrowing plan includes:

- $21.5 billion in foreign loans

- ¥15 billion (Japanese Yen)

- €65 million in grants

Additionally, the president has sought approval for the issuance of ₦757.98 billion in domestic bonds to address pension arrears and raise $2 billion from the domestic financial market to fund other investments.

President Tinubu emphasized that the loans are essential due to declining domestic revenues and the urgent need to revive Nigeria’s aging and overstretched infrastructure. The funds will primarily target sectors such as power, transportation, healthcare, and agriculture, aiming to stimulate economic growth, reduce poverty, enhance food security, and generate employment.

Government’s Position and Debt Management Strategy

The Federal Government clarified that the borrowing plan is a structured, forward-looking framework designed to avoid ad hoc borrowing and ensure fiscal sustainability. The majority of the loans will come from development partners including the World Bank, African Development Bank, French Development Agency, European Investment Bank, Japan International Cooperation Agency (JICA), China EximBank, and the Islamic Development Bank. These institutions offer concessional financing with favorable terms and long repayment periods, supporting Nigeria’s development objectives sustainably.

The government stressed that the new borrowing will not necessarily increase Nigeria’s debt burden, as it replaces maturing obligations and finances growth-enhancing projects. The focus remains on prudent debt management, ensuring borrowed funds are efficiently utilized for economic returns.

Legislative Process and Outlook

The National Assembly’s Committees on Local and Foreign Debts have been tasked with scrutinizing the borrowing proposal, with reports expected within two weeks. Senate President Godswill Akpabio and House Speaker Tajudeen Abbas have both underscored the importance of the loans in bridging the country’s infrastructure deficit and fulfilling the administration’s development agenda.

Context and Background

Since assuming office in 2023, President Tinubu has pursued ambitious economic reforms, including the removal of fuel subsidies and unification of foreign exchange rates. While these reforms have stabilized the economy, they have also contributed to inflation and a cost-of-living crisis. The borrowing plan is part of broader efforts to stimulate growth and improve living standards without imposing additional hardship on Nigerians.

Nigeria recently completed repayment of a $3.4 billion emergency IMF loan obtained in 2020, and as of December 2024, total foreign debt stood at $44.9 billion, with major creditors including Eurobond holders, World Bank, China EximBank, and African Development Bank.