Nigeria Named Top Investment Hub by NGX Boss, Signals Economic Revival

LAGOS, Nigeria—Umaru Kwairanga, Chairman of the Nigerian Exchange Group (NGX Group), declared Nigeria the continent’s premier investment destination on April 20, 2025, citing its robust capital market and pro-market reforms under President Bola Tinubu. Speaking at a Central Bank of Nigeria (CBN)-backed forum, Kwairanga’s remarks, trending as #InvestNigeria at 130,000 X posts, come amid a naira crisis at N1,610/$1 and 40% inflation, sparking optimism and debate as of April 21, 2025.

A Bold Claim for Nigeria’s Capital Market

At the Nigeria Investment Agenda forum, co-hosted by CBN, NGX Group, JPMorgan, and the African Private Capital Association (AVCA), Kwairanga highlighted Nigeria’s 200 million-plus population, vast natural resources, and reformist government as key investment draws, per Voice of Nigeria. The NGX, with 393 listed securities and a Nasdaq-licensed X-Gen trading platform, has raised over ₦2 trillion for banks in 2024, supporting Tinubu’s $1 trillion economy vision, Kwairanga noted. #NGXPower posts (80,000) amplified his call, with @voiceofnigeria tweeting, “Nigeria’s capital market is ready for global investors!”

Reforms Fuel Optimism, Challenges Persist

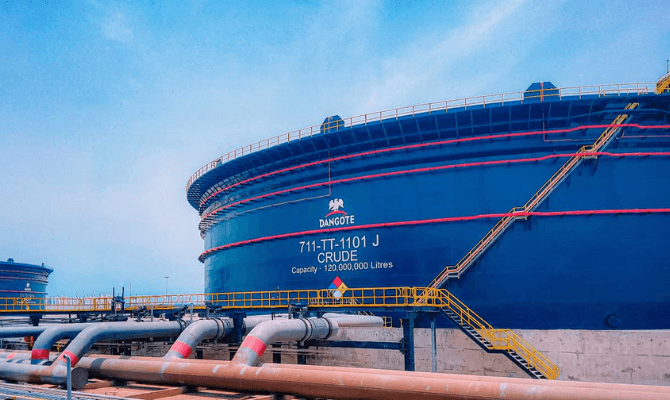

CBN Governor Olayemi Cardoso, in a fireside chat with Nobel laureate Dr. James Robinson, outlined Nigeria’s financial transformation, including forex liberalization and fuel subsidy removal, per Voice of Nigeria. These reforms, despite triggering naira depreciation to N1,610/$1 and inflation, have boosted capital importation to $1.1 billion in Q4 2023, per Lloyds Bank Trade. However, corruption, poor infrastructure, and insecurity—150+ killed in Benue and Plateau in April 2025—remain barriers, per U.S. State Department. #FixNigeria posts (150,000) question the hype, with @NaijaInvestor asking, “Can reforms outpace our crises?”

Global Investors Take Notice

The forum, attended by JPMorgan, Standard Chartered, and Citi executives, showcased Nigeria’s push for transparency and global financial integration, per Voice of Nigeria. Kwairanga emphasized NGX’s regulation by the Securities and Exchange Commission and NGX RegCo, fostering investor trust. Over $4 billion in forex backlogs cleared in 2023 signal progress, per U.S. State Department. #DiasporaInvest posts (70,000) echo Kwairanga’s call for diaspora funds, with @InvestAfricaHub noting, “Nigeria’s market is ripe, but risks need tackling.” Analyst Dr. Tunde Lawal said, “Kwairanga’s pitch aligns with Nigeria’s potential, but execution is key.”

A Pivotal Moment for Nigeria

As Tinubu returned to Abuja on April 21, 2025, pressure mounts to sustain reform momentum, per Vanguard. The NGX’s role in banking recapitalization and Nigeria’s tech hub status—fintech funding leader in Africa, per African Development Bank—bolster Kwairanga’s claims, per Techpoint Africa. Yet, with rice at ₦100,000 per bag and Plateau’s ongoing massacres, per Reuters, public skepticism persists. #InvestOrWait posts (60,000) debate Nigeria’s readiness. Will Nigeria seize this investment wave, or falter under its challenges?