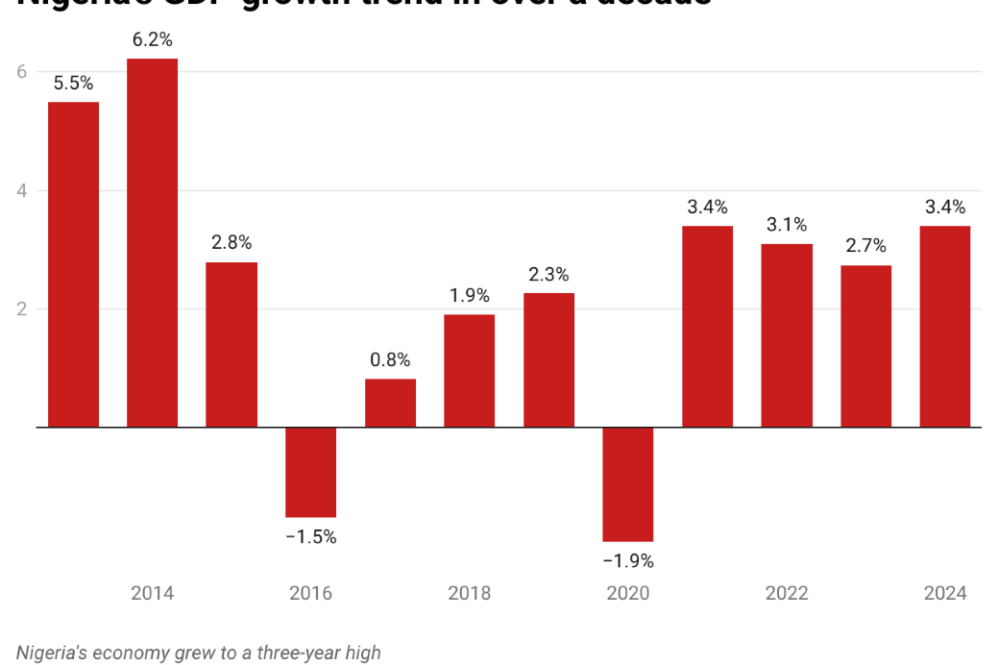

Nigeria’s GDP Growth Surges in 2025, Yet Faces Headwinds

Nigeria’s economy expanded at a robust pace in 2025, with real Gross Domestic Product (GDP) growth projected to reach 3.5% by year-end, up from 3.4% in 2024, driven by services, agriculture, and telecoms, according to estimates from the International Monetary Fund and local analysts. The acceleration, fueled by policy reforms and higher oil output, marks the fastest growth in three years for Africa’s most populous nation. Yet, as the naira weakens to N1,621 per dollar and Trump’s 14% tariffs bite, Nigerians grapple with 40% inflation and dollar scarcity, tempering optimism for President Bola Tinubu’s economic overhaul as of April 12, 2025.

A Strong Start: Services and Oil Lead the Way

Nigeria’s GDP growth gained steam in 2025, with the first quarter recording 2.98% year-on-year, per the National Bureau of Statistics, climbing to an estimated 3.7% in the second quarter, according to PwC projections. The services sector, contributing 58% to GDP, grew 5.4%, powered by fintech and telecoms—think MTN’s 5G rollout and Flutterwave’s unicorn status. Agriculture, despite flood risks, added 1.8%, buoyed by better seedling access. Oil production hit 1.6 million barrels per day, up from 1.54 million in late 2024, thanks to Dangote Refinery’s local supply easing import costs. “Reforms are bearing fruit,” said Finance Minister Wale Edun, crediting subsidy cuts and forex unification.

Numbers Tell the Tale: Billions Added

In nominal terms, Nigeria’s GDP is forecast to hit $268 billion by December 2025, a $68 billion jump from 2024’s $200 billion, per IMF estimates, reflecting both growth and currency adjustments. Real GDP, adjusted for inflation, reached roughly $585.9 billion by Q3, up from $567.7 billion in 2024, per World Economics. The 3.5% growth translates to an additional $20 billion in economic activity, enough to fund Nigeria’s entire 2025 health budget twice over. Telecoms alone added N2.5 trillion, while non-oil exports—cocoa, sesame—rose 30% to N1.8 trillion, per the CBN. But with debt servicing eating 68% of revenue, the gains feel distant for many.

Struggles Beneath the Surface: Inflation Bites

Despite the numbers, life hasn’t eased for most Nigerians. The naira’s slide to N1,621/$1 on April 10, driven by dollar scarcity and oil prices at $57, fuels 40% inflation, per NBS. “Rice is N100,000 a bag—growth doesn’t feed my kids,” said Lagos trader Aisha Muhammed. Protests flared in Kano, with #NairaCrisis hitting 110,000 X posts by April 11, reflecting anger over fuel at N950/litre. Trump’s tariffs, slashing $6 billion in exports, threaten jobs in agriculture, while insecurity—3,800 abductions in 2025—deters investment. “GDP’s up, but so is suffering,” noted economist Dr. Muda Yusuf, urging broader reforms.

Reforms Under Fire: Tinubu’s Gamble

Tinubu’s 2023 subsidy removal and naira float, hailed by the World Bank as “bold,” boosted revenues by 91% to N1.87 trillion in Q1 2025, per FAAC. Yet, the CBN’s $200 million weekly forex injections barely dent the parallel market’s grip. “We’re growing, but not fast enough for 230 million people,” said analyst Victor Aluyi. Plans to rebase GDP data in 2025, capturing tech and creative sectors, could show even higher growth, but critics like Peter Obi warn of “collapse” without inclusive policies. X posts (#TinubuEconomy, 60,000) split between hope for reforms and frustration over costs.

Looking Ahead: Growth or Gridlock?

Nigeria’s 3.5% growth in 2025, projected to hit 4.1% in 2026 by the World Bank, offers a lifeline. Dangote’s refinery, now at 650,000 bpd, could stabilize fuel prices, while AfCFTA promises trade gains. But with oil’s volatility and tariffs looming, the path is fraught. “This growth is real, but it must reach the streets,” said Dr. Amina Jega. For now, Nigeria’s economy surges on paper, yet millions wait to feel its pulse. Will Tinubu’s vision deliver, or will global pressures and local pains stall the climb?