Nigeria Braces for Revenue Hit from Oil Price Slump After Trump Tariffs

Nigeria is staring down a looming fiscal crisis as global oil prices plummeted to a four-year low of $57 per barrel on April 10, 2025, following U.S. President Donald Trump’s imposition of sweeping 14% tariffs on Nigerian exports, effective April 9. With oil accounting for 90% of the nation’s foreign exchange earnings, officials warn the slump—far below the 2025 budget benchmark of $75 per barrel—could slash billions from revenue, deepen the budget deficit, and force more borrowing. As Africa’s largest oil producer scrambles to adapt amid fears of a global recession, the tariffs’ ripple effects are testing Nigeria’s economic resilience as of April 11, 2025.

Tariffs Trigger Oil Price Crash

Trump’s “Liberation Day” tariffs, announced last week and fully enacted April 9, slapped a 14% duty on Nigerian imports, part of a broader policy targeting “unfair trade practices” like Nigeria’s bans on U.S. beef and pharmaceuticals. While oil exports to the U.S. are exempt, the tariffs—coupled with a surprise OPEC+ output hike of 411,000 barrels per day—sent Brent crude tumbling 16% since April 2, from $70 to $57, per market data. “This is a double blow—tariffs and oversupply,” said Trade Minister Jumoke Oduwole, warning of “destabilizing challenges” to Nigeria’s $6 billion annual U.S. export market.

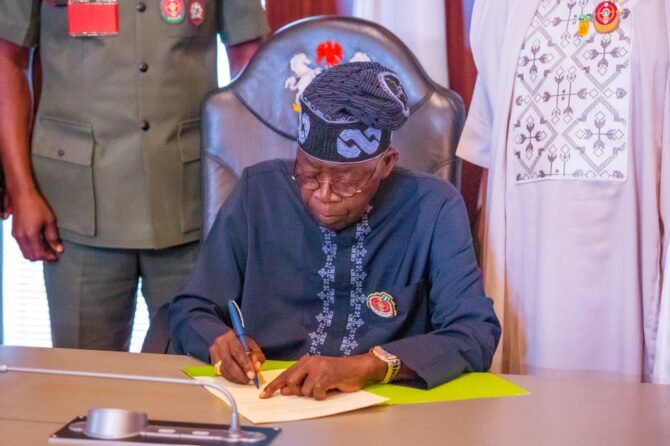

Budget in Jeopardy: A $10 Billion Gap

Nigeria’s 2025 budget, signed by President Bola Tinubu, hinges on oil at $75 per barrel and 2.06 million barrels daily production. With prices now at $57 and output lagging at 1.5 million bpd, the shortfall could exceed $10 billion, economists estimate. The Central Bank of Nigeria (CBN) sold $197.71 million to prop up the naira on April 6, but forex reserves—down 34 days straight—signal trouble. “Revenue will drop, borrowing will rise,” warned Prof. Kabiru Isa Dandago of Bayero University, Kano, noting projects like road repairs and power upgrades may stall.

Economic Fallout: Diversification Falters

The oil slump threatens Nigeria’s decades-long push to diversify beyond crude, which still dominates despite 3.4% GDP growth in 2024. Non-oil exports like cocoa and fertilizers—$200 million of $3.8 billion to the U.S. in 2023—face new costs under tariffs, per the National Bureau of Statistics. “Competitiveness is gutted,” said exporter Chukwu Eze, predicting job losses in agriculture. Posts on X, like #TrumpTariffsNigeria (80,000 mentions), reflect panic: “Oil down, naira next,” one user wrote. The African Growth and Opportunity Act (AGOA), set to expire in September, now seems doomed, further isolating Nigeria’s trade.

Government Response: Scramble for Solutions

Tinubu’s team is reeling. Oduwole called the crisis “a catalyst to fast-track diversification,” pushing trade with China and India. The CBN may raise interest rates to curb inflation—already 40%—while Finance Minister Wale Edun hinted at budget cuts or more debt, already up 68% to N13 trillion for servicing. “We’re not immune when America sneezes,” Edun admitted. Analysts suggest leaning on the African Continental Free Trade Area (AfCFTA), but with oil revenue tanking, options are slim. “Nigeria must act fast or sink deeper,” said Victor Aluyi of Aztran Global Investments.

Global Recession Looms: Nigeria’s Test

The oil plunge, fueled by Trump’s tariffs and OPEC+ moves, stokes fears of a global downturn. Goldman Sachs cut its 2025 Brent forecast to $69, citing trade war risks, while Nigeria’s stock market shed N659 billion on April 7. “This could tip us into recession,” warned Muda Yusuf of the Centre for Promotion of Private Enterprises. As protests over N950/litre fuel persist and Boko Haram surges, Nigeria’s resilience hangs in the balance. Can it weather this storm, or will the tariff shock prove too much?