Revenue Growth and Profitability

Nigerian Breweries Plc has released its audited Group Financial Statements for FY’24. Consequently, the company recorded an impressive revenue of N1.1 trillion. Meanwhile, this represents an 81% increase from N599.6 billion in 2023.

Gross Profit and Operating Profit Growth

Furthermore, the company’s group gross profit grew significantly by 51% from N212.6 billion to N320 billion. Consequently, the operating profit also grew by 59% from N44 billion to N70 billion.

Strategic Initiatives and Cost Management

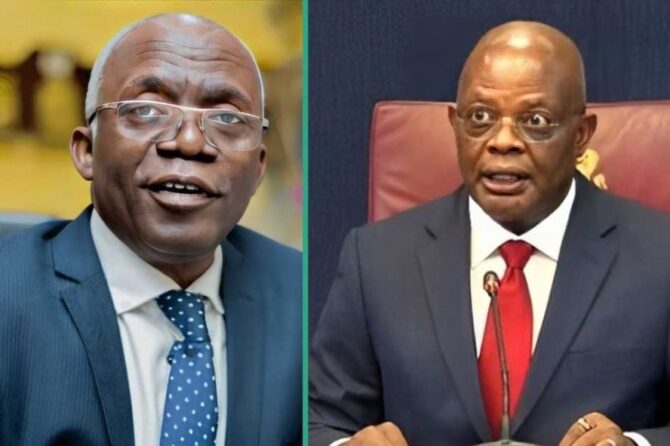

Hans Essaadi, Managing Director/CEO, attributes the revenue growth to strategic pricing initiatives. Additionally, market expansion, successful innovations, and operational efficiencies contributed to the growth. Meanwhile, Essaadi notes that cost management and process optimisation drove the operating profit surge.

Challenges and Financial Performance

Despite macroeconomic headwinds, the company faced challenges. Consequently, the net finance costs increased by 34%, and the net loss rose to N144.9 billion. However, the company took bold steps to address these issues.

Recovery Plan and Rights Issue

The board obtained shareholder support for the company’s recovery plan. Consequently, a successful rights issue was conducted. Meanwhile, the proceeds from the Rights Issue reduced future currency risks.

Return to Profitability

The company demonstrated strong recovery and positive momentum in Q4 2024. Consequently, revenue grew by 89%, and operating profit increased by 145%. Meanwhile, the net finance costs decreased by 75%, leading to a return to profitability.

Outlook and Future Prospects

Uaboi Agbebaku, company Secretary/Legal Director, appreciates shareholders for their support. Consequently, the company will continue to navigate challenges and focus on agility, innovation, and operational excellence. Meanwhile, the company remains committed to maintaining its improved financial position.

Prospects for the future

The future looks bright for Nigerian Breweries, with the company recently releasing its audited Group Financial Statements for the financial year ended December 31, 2024. The results show an impressive revenue of N1.1 trillion, representing an 81% increase from the previous year.

This significant growth is attributed to strategic pricing initiatives, market expansion, successful innovations, and operational efficiencies. The company’s managing director/CEO, Hans Essaadi, notes that despite macroeconomic challenges, the group’s operating profit surged by 54%.

Nigerian Breweries has also taken bold steps to strengthen its financial position, including a successful rights issue that has started to yield positive results. The company has demonstrated strong recovery and positive momentum in the last quarter of 2024, with revenue growing by 89% and operating profit increasing by 145%.

Looking ahead, Nigerian Breweries is focused on agility, innovation, and operational excellence to navigate the challenges of the Nigerian business environment. The company aims to maintain its improved financial position and reduce future currency risks.

Some key areas to watch for Nigerian Breweries’ future growth include:

Strategic Expansion: The company’s plans to expand its market share and explore new business opportunities.

Innovation and Product Development: Nigerian Breweries’ efforts to innovate and develop new products to meet changing consumer preferences.

Sustainability and Corporate Social Responsibility: The company’s initiatives to reduce its environmental footprint and contribute to the well-being of its stakeholders.

Overall, Nigerian Breweries’ future looks promising, with the company well-positioned to navigate challenges and capitalise on opportunities in the Nigerian market.

Coping with competitors

Nigerian Breweries is facing stiff competition in the Nigerian beer market, particularly from International Breweries, a subsidiary of AB InBev, the world’s largest beer producer. To cope with the competition, Nigerian Breweries have been focusing on strategic pricing initiatives, market expansion, successful innovations, and operational efficiencies.

The company has also been investing in sponsorships and marketing promotions to maintain its market share. For instance, Nigerian Breweries spent over N2 billion on above-the-line advertising activities in 2016. Additionally, the company has been expanding its product portfolio through acquisitions, such as the acquisition of Distell Wines and Spirits Nigeria Limited in 2024.

Nigerian Breweries is also leveraging its partnership with Heineken, its parent company, to drive growth and innovation. The company has been benefiting from Heineken’s global expertise and resources, which has enabled it to stay competitive in the market.

Some of Nigerian Breweries’ main competitors in the Nigerian beer market include:

International Breweries: A subsidiary of AB InBev, the world’s largest beer producer

Guinness Nigeria: A subsidiary of Diageo, the world’s largest producer of spirits

Hartwall: A Finnish brewing company

SUPER BOCK: A Portuguese brewing company

Alken-Maes: A Belgian brewing company

Overall, Nigerian Breweries is coping with the competition by focusing on strategic initiatives, investing in marketing and sponsorships, and leveraging its partnership with Heineken.